A Comprehensive Exploration of Stock Markets, Their Functions, and Their Impact on the Global Economy

By Kyrt Smith Staff Writer

In the financial sector, few institutions are as iconic and influential as the stock market. These operating centers of monetary activity function as a basic barometer of economic fitness and also offer a platform for people and institutions to invest money in and allocate capital. We present the complexities of stock markets, their specific features, and their serious impact on the worldwide economy.

In an extraordinary display of resilience and power, international stock markets have reached remarkable heights, strengthened by a wave of optimism surrounding the worldwide economy. Investors are riding a positive wave as key indexes break statistics, showcasing the terrific recovery from the challenges of the past few years.

Understanding Stock Markets

A stock market, also called an equity market or a share market, is a centralized platform wherein people and institutions should buy and sell ownership stakes in publicly traded corporations. These ownership stakes, referred to as shares or stocks, represent a claim on a part of the corporation’s property and profits.

Diversify Your Portfolio

Diversification is an essential strategy that facilitates risk mitigation. Rather than placing all of your cash right into a single stock or sector, unfold your investments across unique asset classes and industries. This approach can help cushion the impact of risky assets and reduce average portfolio threat. Consider allocating your investments to stocks, bonds, property, or even alternative investments like cryptocurrencies or commodities.

Invest for the Long Term

The stock market can be noticeably volatile within a short time period; however, records have proven that it usually trends upward over the long haul. A long-term investment horizon lets you adapt to financial marketplace fluctuations and take advantage of compounding returns. Patience is a virtue in making an investment, and adopting a buy-and-preserve strategy can result in substantial wealth accumulation over the years.

Dollar-Cost Averaging

Timing the market perfectly is notoriously tough, even for seasoned brokers. Dollar-cost averaging is an approach wherein you make investments in a set amount of cash at regular intervals, regardless of market conditions. This method enables you to lessen the impact of market volatility and allows you to buy more shares when fees are low and fewer shares when prices are high, in the long run decreasing your common price per share.

Research and Due Diligence

Informed stock-buying selections are the bedrock of successful investing. Before investing in a company or asset, conduct thorough research. Analyze financial statements, investigate asset management history, and keep in mind the competitive panorama. Staying knowledgeable about market developments and economic indicators is also important. Knowledge is energy in the world of decision-making and investment.

Risk Management

Risk is a part of the investing process, and powerful risk management can help protect capital. Consider putting prevent-loss orders in place to restrict losses on separate stocks. Diversification, as already explained, is a powerful risk management strategy. As people say, don’t place all your eggs in the same basket.

Emotion Control

Emotions can be a vast impediment to success in investing. Fear and greed often power impulsive stock selections that could lead to losses. Develop a disciplined method for your investments, and keep away from making hasty decisions primarily based on marketplace sentiment. Creating a properly defined funding plan and sticking to it lets you stay away from emotional pitfalls.

Stay Informed, But Avoid Overtrading

Staying knowledgeable about market news and developments is essential, but overtrading may be damaging. Frequent buying and selling can result in excessive transaction costs and tax expenses. Make deliberate, nicely-reasoned selections, and avoid the temptation to constantly mess with your portfolio.

Knowing the Stock Market

Knowing the stock market is comparable to studying a complex and dynamic environment. It involves knowing the intricacies of diverse financial contraptions, tracking the ever-evolving global economic landscape, and interpreting the psychology of marketplace participants. Successful navigation of the inventory market now requires not only the simplest technical understanding but additionally a deep comprehension of market sentiment and human behavior.

From reading monetary statements and market tendencies to dealing with risk and making informed investment decisions, a profound understanding of the stock market is the key to unlocking the potential for wealth creation and economic protection.

The Role of Stock Markets

- Capital Allocation: Stock markets play an important role in capital allocation. Companies issue shares to elevate the price range for numerous functions, which include expansion, studies and improvement, and debt reimbursement. Investors purchase these stocks, providing groups with the necessary capital to grow and innovate.

- Liquidity: Stock markets provide liquidity to investors, allowing them to buy or sell stocks quite quickly and without problems. This liquidity is essential for investors to get admission to their capital when needed and for groups to secure financing.

- Price Discovery: Stock prices are determined by the market forces of delivery and demand. As a result, stock markets serve as a mechanism for price discovery, reflecting the collective expectations and sentiments of investors regarding an organization’s overall performance and prospects.

Types of Stock Markets

There are different types of stock markets, each with its own characteristics and policies. The most common are:

- Primary Market: This is where organizations struggle to raise capital via tactics like preliminary public offerings (IPOs). Investors buy those newly issued stocks without delay.

- Secondary Market: The secondary market is where traders purchase and sell stocks amongst themselves. It consists of well-known exchanges like the New York Stock Exchange (NYSE) and the NASDAQ.

- Global Markets: In the new fast-paced economy, many organizations list their shares on more than one global stock exchange to gain access to more buyers.

Stock Market Indexes

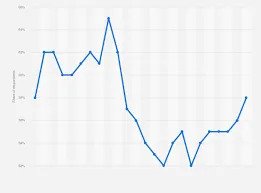

Stock market indexes determinate the state of a stock market. Known indexes in the US include the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite. These indexes monitor a collection of stocks. Providing insight into the state of the stock market.

Volatility and Risk

Stock markets are inherently volatile, subject to fluctuations driven by economic, political, and psychological factors. While they provide possibilities for investors to generate wealth, they also bring risks. Understanding market risk and diversification is vital for careful investing.

Economic Impact

Stock markets are important for monetary balance and growth. They facilitate entrepreneurship, innovation, and process innovation by providing organizations with access to capital. Rising stock prices can improve buyer confidence and investment, while falling markets can result in financial slowdowns.

The Global Perspective

Globalization has interconnected stock markets, allowing stock market investors to access international investing possibilities. This interconnectedness means that activities in one part of the world can have consequences to other parts of the world financial markets. For instance, a crisis in one of the financial stock markets can cause a global stock market downturn in many other countries’ stock markets.

Regulation and Oversight

Government agencies and regulatory bodies oversee stock markets to ensure fairness and transparency. In the US, the Securities and Exchange Commission (SEC) plays a crucial function in regulating the securities industry.

Conclusion: The Stock Market

Stock markets are more than just structures for trading stocks; they may be the lifeblood of the worldwide economy. They allocate capital, force innovation, and replicate the collective sentiments of buyers. While they offer possibilities for wealth accumulation, they also pose risks. Understanding the intricacies of stock markets is crucial for people and establishments navigating the complicated world of finance and for societies at large, as they play a vital function in shaping the financial landscape of our interconnected world.

Leave a Reply