In the intricate web of global technology and economics, where nations strive for self-reliance amid volatile markets, Japan is channeling its innovative spirit into reclaiming a leading role in semiconductors. With Rapidus at the helm, this ambitious effort represents a strategic pivot toward tech sovereignty, addressing geopolitical risks, supply chain disruptions, and the escalating need for cutting-edge chips that underpin modern life from consumer devices to artificial intelligence.

Japan’s semiconductor journey has been marked by triumph and decline, shaped by broader economic forces that highlight the interconnectedness of industries worldwide. For instance, as competition heated up from Taiwan and South Korea, fluctuations in currency values played a subtle yet significant role in trade dynamics, often leading observers to ponder what is forex and why it is important, influencing everything from export pricing to investment flows in tech sectors.

Back in the 1980s, Japan commanded over half the global chip market, with firms like Toshiba and NEC pioneering high-quality production that fueled the electronics revolution. However, by the 2020s, its share had shrunk to about 10 percent, overtaken by TSMC’s dominance in advanced processes and Samsung’s aggressive scaling. The COVID-19 crisis laid bare supply vulnerabilities, while U.S.-China tensions restricted tech transfers, elevating chips to the status of strategic assets. Japan recognized that dependence on overseas suppliers for vital components in automobiles, defense, and data infrastructure posed unacceptable risks, prompting a drive for domestic control and innovation.

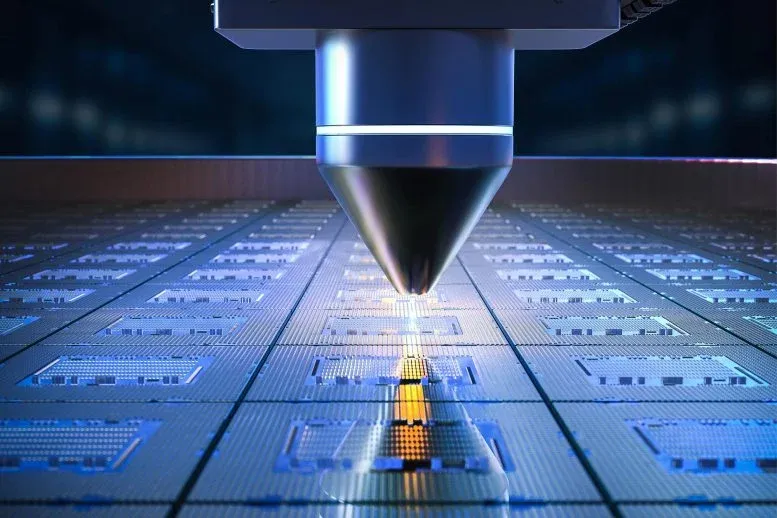

Rapidus embodies this resurgence, founded in 2022 with government support and investments from eight key players including Toyota, Sony, and Kioxia. The company’s mission is to mass-produce 2-nanometer (nm) logic chips by 2027, a leap that would position Japan alongside industry frontrunners. Named for its emphasis on rapidity, Rapidus operates from Tokyo headquarters but centers its operations in Chitose, Hokkaido, where the cooler environment and expansive land suit power-hungry fabrication plants. Groundbreaking for the Innovation Integration Manufacturing (IIM-1) facility occurred in September 2023, transforming the area into a budding semiconductor cluster.

Financial commitment from the government has been substantial, reflecting the stakes involved. In late 2025, Japan unveiled plans to quadruple its budget for semiconductors and AI, directing approximately 150 billion yen toward Rapidus within a larger 1 trillion yen initiative. This funding supports not only construction but also R&D, workforce development, and international ties.

A pivotal alliance with IBM grants access to 2nm gate-all-around (GAA) transistor tech, which offers superior efficiency over conventional designs. In August 2025, Rapidus forged a partnership with Keysight Technologies to boost yield rates and craft precise process design kits (PDKs) for these nodes. By December 2025, the company introduced AI-enhanced design tools slated for rollout in 2026, aimed at optimizing chip layouts and accelerating development for Japanese engineers.

Milestones are accumulating steadily. In July 2025, Rapidus announced the successful prototyping of a 2nm GAA transistor at IIM-1, confirming electrical functionality and paving the way for further refinement. Plans are afoot to release a PDK to select customers in the first quarter of 2026, enabling early chip design work. Looking further out, reports indicate Rapidus intends to commence construction on a second Hokkaido facility in 2027, with eyes on 1.4nm production by 2029 or the decade’s close—though details remain tentative. Additionally, in December 2025, the firm revealed a prototype for a glass substrate interposer, potentially entering production by 2028 to support larger, more complex chips.

This push integrates with wider ecosystem enhancements. Japan has welcomed foreign expertise, such as TSMC’s Kumamoto plants—one operational since 2024 and another advancing toward 2027 production—fostering job creation and skill-sharing. Under the Economic Security Promotion Act, semiconductors are classified as critical materials, streamlining regulations and fortifying against external shocks. The goal is to triple domestic sales to exceed 15 trillion yen by 2030, through incentives for startups, research hubs, and training programs.

Obstacles persist, however. Mastering sub-2nm tech demands rare expertise, and Japan grapples with a shortage of specialized engineers, many of whom are drawn abroad by lucrative offers. Fabrication costs are enormous, often in the tens of billions of dollars, requiring swift commercialization to match TSMC’s scale. Geopolitical frictions, particularly with China, could hinder material supplies, and skeptics question the feasibility of Rapidus’s timeline amid potential technical setbacks.

Nevertheless, the potential rewards are immense. A thriving Rapidus could insulate Japan from import dependencies, invigorating sectors like automotive where Toyota’s stake aligns with the chip needs of electric vehicles. It might also recalibrate global balances, providing diversification from Taiwan and aligning with U.S. initiatives like the CHIPS Act through alliances such as Chip 4. As semiconductors evolve into the backbone of digital economies, Japan’s endeavor underscores that true sovereignty demands not just production capacity but sustained ingenuity and collaboration, ensuring the nation doesn’t merely catch up but leads in the next wave of technological advancement.

Leave a Reply