Weighing Factors, Analyzing Trends, and Making Informed Decisions: Should I Buy Tesla Stock Now?

Author: Kyrt Smith

Staff Writer

In the fast-paced and ever-evolving realm of stock trading, few companies have captured the world’s attention and imagination like Tesla. The electric vehicle and renewable energy giant’s meteoric rise and innovative approach to technology have made it a focal point for investors seeking both growth and sustainability. As the market navigates through changes and fluctuations, the question arises: Should you buy Tesla stock now? This article aims to guide prospective investors through the considerations that could influence such a decision.

1. Analyzing Tesla’s Performance

The first step in assessing whether to invest in Tesla stock is to understand its financial performance. Examine the company’s revenue growth, earnings reports, and profit margins. Tesla’s ability to consistently deliver strong financial results is a positive indicator of its stability and potential for growth.

2. Market Trends and Sentiment

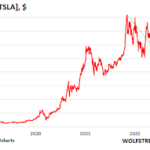

Study the prevailing market sentiment surrounding Tesla. Is the stock experiencing an upward trend, or has it recently faced significant fluctuations? Are there external factors such as economic conditions, technological advancements, or regulatory changes that could impact Tesla’s stock price? Consider both short-term volatility and long-term growth potential.

3. Industry Landscape

Evaluate Tesla’s position within the broader electric vehicle and renewable energy sectors. Are there emerging competitors that could threaten Tesla’s market share? Additionally, assess how Tesla’s innovations, such as self-driving technology and battery advancements, could position it as a leader in the future of transportation and energy.

4. Sustainability and ESG Factors

Environmental, social, and governance (ESG) considerations have gained prominence in recent years. Tesla’s commitment to sustainability and its role in combating climate change may resonate with investors seeking companies aligned with their values. A strong ESG profile can enhance long-term investor confidence.

5. Long-Term Vision

Understand Tesla’s long-term strategic goals. How does the company plan to expand its market reach and product offerings? Consider Elon Musk’s vision for the company and evaluate whether Tesla’s plans align with a trajectory of continued growth.

6. Risk Management

Every investment carries risks. Tesla’s stock price can be influenced by various factors, including market sentiment, regulatory changes, and technological advancements. Diversifying your investment portfolio can help mitigate potential losses from fluctuations in a single stock’s price.

7. Seeking Professional Advice

If you’re uncertain about making investment decisions on your own, seeking advice from financial professionals can be beneficial. Financial advisors can provide personalized insights based on your financial goals, risk tolerance, and investment horizon.

8. Timing and Patience

Timing is crucial in stock trading, but it’s important to recognize that predicting short-term fluctuations can be challenging. Even if you believe in Tesla’s long-term potential, consider your investment horizon. Stocks can experience short-term volatility before realizing their growth potential.

Deciding whether to buy Tesla stock now is a complex decision that depends on a combination of factors. It’s essential to conduct thorough research, analyze the company’s financial performance, consider industry trends, and evaluate your own investment goals and risk tolerance.

Tesla’s role in the evolving landscape of electric vehicles and renewable energy, along with its innovative technologies, can make it an appealing investment for those seeking both financial growth and positive environmental impact. Ultimately, the decision should be based on a comprehensive understanding of the company’s fundamentals and your own investment strategy.

Leave a Reply