Cryptocurrency is surging into 2025 as a maturing, global digital asset class defined by technological leaps, mainstream adoption, and legislative evolution. Let’s explore the pivotal trends shaping the crypto landscape this year. Following the volatility of 2023–2024, 2025 feels like a maturation phase for crypto, reminiscent of how the internet stabilized after the dot-com bubble.

What Are Crypto Trends?

Crypto trends refer to the major shifts and emerging patterns that shape the development and adoption of digital assets and blockchain technology. In 2025, key crypto trends include the widespread adoption of stablecoins as reliable payment and liquidity tools, rapid growth in asset tokenization enabling fractional ownership in real-world assets, and deeper integration of artificial intelligence for efficiency and security.

Regulatory clarity and institutional investment are driving greater trust, while decentralized finance (DeFi) and new financial products continue to revolutionize how people manage, trade, and safeguard value in the digital era.

Crypto Market Trends 2025

The crypto market in 2025 is defined by a renewed bullish sentiment and rapid innovation following the volatility of previous years. Key trends include increased regulatory clarity, which is attracting new investors and bringing stability to the market. Stablecoins have become a cornerstone, facilitating over one billion transactions annually and surpassing $8 trillion in transfer value, thereby expanding crypto adoption globally. Adoption is surging. But challenges remain.

Tokenization of real-world assets such as real estate and art is unlocking new liquidity and accessibility, while the rise of decentralized finance (DeFi) and AI-driven technologies is transforming both trading and investment strategies. The total cryptocurrency market cap reached a record high of over $3 trillion, illustrating explosive growth fueled by mainstream interest, institutional investment, and integration across industries.

Regulatory Clarity and Growth

2025 is a landmark year for crypto policy worldwide, with new laws bringing clarity to digital assets. In the U.S., the administration has pivoted from enforcement-driven regulation to crafting clear rules. Major bills address stablecoins—introducing federal licensing, strict reserve requirements, and greater SEC/CFTC oversight, aiming to promote market stability and investor confidence. Regulatory clarity is improving. But will it last?

Asian centers such as Hong Kong and Singapore offer robust licensing frameworks for exchanges and stablecoin providers, while the European Union’s MiCA regulation harmonizes market rules for crypto issuers. This more predictable regulatory landscape is helping reduce volatility and encourage institutional investment.

Adoption, User Growth, and Regional Trends

Global crypto adoption sits at a record high between 12% and 15% of the population. India leads with around 119 million users, followed by heavy engagement in countries like Nigeria, the United States, and Vietnam. North America owns about 16% market share, while the Asia-Pacific region has become a powerhouse, accounting for nearly 38% of the crypto market in 2025. Key drivers include inflation protection, fast cross-border payments, and unbanked population access.

What Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging their price to an external reference, most commonly a fiat currency like the US dollar, or sometimes commodities like gold. Unlike traditional cryptocurrencies, which can experience significant price swings, stablecoins aim to provide price predictability by holding reserves in regulated financial institutions, using overcollateralization, or relying on algorithmic mechanisms to balance supply and demand.

Their stability makes stablecoins an essential tool for payments, trading, and cross-border transactions within the cryptocurrency ecosystem, providing users with a digital asset that is less susceptible to the volatility seen in coins such as Bitcoin or Ether. Interestingly, while algorithmic stablecoins promise innovation, their historic volatility reminds us that technology alone cannot guarantee trust.

Common Types of Stablecoins and How They Differ

Stablecoins come in several common types, each defined by their underlying mechanism for maintaining price stability:

Fiat-Backed Stablecoins

These stablecoins are backed 1:1 by fiat currency reserves such as the US dollar or euro, held in bank accounts or short-term government securities. Examples include Tether (USDT) and USD Coin (USDC). Their value is directly tied to a traditional currency, making them relatively stable and simple to understand, though reliant on the trustworthiness and transparency of the issuer’s reserve management.

Commodity-Backed Stablecoins

Commodity-backed stablecoins are pegged to physical assets like gold or silver. Examples include PAX Gold (PAXG) and Tether Gold (XAUT). The value of these coins fluctuates with the underlying commodity, and holders can sometimes redeem tokens for the actual physical asset.

Crypto-Backed Stablecoins

These stablecoins are collateralized by other cryptocurrencies and typically use smart contracts to maintain over-collateralization, protecting against the volatility of the backing crypto. MakerDAO’s DAI is a well-known example. Crypto-backed coins often appeal to decentralized finance users but present unique risks; they may liquidate collateral if its value drops sharply.

Algorithmic Stablecoins

Instead of using reserves, these stablecoins maintain their peg with programmed incentives or supply adjustments. TerraUSD (UST, now defunct) and newer projects like USDe use algorithms to mint or burn coins based on market prices. While highly innovative, these coins are considered high-risk, as their stability depends entirely on continued market confidence and behavioral incentives.

The main differences among these types lie in what backs them (fiat, crypto, commodities, or algorithms) and the level of risk, regulatory oversight, and trust required by holders to maintain stability.

The Rise of Stablecoins and Tokenization

Stablecoins such as USDT and USDC are redefining payments and remittances, with more than a billion transactions yearly and global value transfer exceeding $8 trillion. Singapore is piloting stablecoin settlement for trade, and Latin American users increasingly rely on stablecoins to bypass banking limitations. Simultaneously, tokenization is revolutionizing real-world assets: real estate, art, and even fund shares are now tradable as fractional blockchain tokens, opening new doors for individual and institutional investors alike.

Euro Crypto Stablecoin: A New Era for European Payments

In September 2025, nine leading European banks—including ING, UniCredit, CaixaBank, and Danske Bank—announced an industry consortium to launch a euro-backed stablecoin regulated under the EU’s Markets in Crypto-Assets Regulation (MiCAR).

This digital asset is designed to provide instant, low-cost payments and settlements, supporting 24/7 cross-border transactions and programmable payments across Europe’s financial system. The initiative aims to create a credible European alternative to US dollar-dominated stablecoins, fostering strategic autonomy and compliance with strict regulatory and transparency standards.

The stablecoin will be backed 1:1 by euro reserves held at regulated institutions, improving trust for both retail and corporate users. Scheduled for launch in the second half of 2026, the euro stablecoin seeks to transform digital commerce, supply chain management, and financial integration throughout the eurozone.

DeFi, AI, and Tech Innovations

Decentralized Finance (DeFi) is entering mainstream use with increased focus on user security, anti-fraud standards, and regulatory compliance. Artificial intelligence now drives both risk management and trading algorithms, giving rise to innovative investment tools. Smart contract advancements, improved scaling, and interoperability across blockchains further support this growing ecosystem.

Crypto Market Leaders and Performers

Bitcoin and Ethereum continue to lead in value and market influence. However, Solana, XRP, and Binance Coin are strong contenders, offering rapid transactions and unique DeFi options. Memecoins and social-tied tokens retain popularity, backed by viral trends and community-driven projects.

Security, Crime, and Compliance

In 2025, crypto-related crime losses topped $2.1 billion in just the first half of the year, bringing attention to the need for more robust security and compliance. Enhanced transaction monitoring, multi-factor authentication, and regulatory tech partnerships are becoming standard as exchanges and wallets prioritize safety and transparency.

The Impact of Stablecoins on Global Crypto Adoption in 2025

Stablecoins have had a profound impact on global crypto adoption in 2025, acting as a catalyst for the mainstream use of digital assets, international payments, and financial inclusion. The following analysis outlines their influence across several crucial dimensions:

Dramatic Growth and Remittance Revolution

Stablecoin adoption sharply increased in 2025, with transaction volumes rising over 66% year-over-year and total stablecoin transfers hitting record highs—$15.6 trillion in Q3 2025 alone. Stablecoins became the backbone for cross-border payments and remittances, reducing fees from approximately 6% (traditional banks) to just 2–3%, and sometimes as low as 0.1% for retail payments. This cost reduction—coupled with instant global settlements—dramatically improved financial access for unbanked populations in high-inflation or economically unstable regions such as Nigeria, India, and South Asia.

Merchant Acceptance and Retail Adoption

Over 25,000 merchants worldwide now accept stablecoins for online transactions, providing users and retailers with lower fees and faster settlements compared to credit cards (3.5% vs. 0.1% typical fee). Small retail payments under $250 are at all-time highs, especially on Ethereum and BSC, indicating that stablecoins are no longer just trading tools but have become everyday spending instruments.

Institutional and Corporate Uptake

Corporate adoption grew by 25% in 2025, with enterprises leveraging stablecoins for supply-chain settlements and cross-border B2B payments, capitalizing on their transparency and efficiency. Stablecoins are now integral to decentralized finance (DeFi), accounting for nearly 40% of DeFi’s $123.6 billion total value locked in 2025.

Regulatory Progress and Stability

Regulatory initiatives such as the U.S. GENIUS Act and Europe’s MiCA gave stablecoins new legitimacy and defined operational standards—focusing on transparency, reserve requirements, and anti-money laundering measures. This clarity fostered confidence among consumers and institutions, propelling further adoption.

Financial System Integration and Future Implications

Major card networks like Visa and Mastercard began natively supporting stablecoins, and large corporations such as Walmart and Amazon are piloting stablecoin-based payment systems. This integration signals a transition toward stablecoins being used alongside, or even in place of, traditional fiat in certain contexts. As a result, stablecoins are reinforcing the role of the US dollar internationally while challenging conventional banking and remittance infrastructures.

Crypto Regulation Updates 2025

The year 2025 marks a pivotal shift in global cryptocurrency regulation, driven by efforts to establish clearer, more comprehensive frameworks. In the United States, landmark legislation such as the GENIUS Act signals a move from enforcement-heavy approaches to structured regulatory clarity, resolving longstanding jurisdiction issues between agencies like the SEC and CFTC.

The establishment of a dedicated SEC Crypto Task Force emphasizes supporting innovation while enhancing fraud protection and consumer safeguards. Meanwhile, the EU’s Markets in Crypto-Assets Regulation (MiCA) continues its rollout, imposing uniform licensing and operational rules to foster investor protection and market stability.

Asian financial centers, including Hong Kong and Singapore, are also advancing rigorous licensing regimes and stablecoin regulations aimed at blending innovation with risk management. These regulatory developments collectively aim to balance fostering crypto innovation with ensuring transparency, security, and investor confidence in an increasingly institutionalized digital asset market.

Main Risks Stablecoins Pose to Monetary Sovereignty

The main risks stablecoins pose to monetary sovereignty in 2025 can be summarized as follows:

1. Currency Substitution (“Dollarization”)

Widespread adoption of foreign-currency stablecoins—especially those pegged to the US dollar—can undermine a country’s national currency, leading to “dollarization.” This reduces central banks’ control over the domestic money supply, exchange rates, and monetary policy tools, as citizens and businesses shift savings and payments away from the local currency to stablecoins.

2. Capital Flight and Loss of Policy Effectiveness

Stablecoins enable unrestricted capital flows across borders. In crisis scenarios, users may quickly convert local assets into stablecoins to protect value, resulting in rapid capital flight, destabilizing domestic financial markets, and complicating central bank attempts to stabilize the economy.

3. Erosion of Central Bank Revenue and Banking System Weakening

When demand for stablecoins reduces reliance on physical cash and traditional bank deposits, central banks can lose critical seigniorage revenue (the income generated from issuing currency). Simultaneously, banks face reduced funding from deposits, potentially restricting credit creation and weakening financial stability.

4. Regulatory and Transparency Challenges

Stablecoins often operate outside comprehensive regulatory oversight, raising transparency issues around asset backing, redemption, and reserve quality. This opacity poses risks for monetary authorities, who cannot reliably monitor or influence the total effective money supply.

5. Financial Stability and Systemic Risk

Runs on stablecoin issuers or controversies over their asset quality can force fire sales of reserve assets, destabilizing financial markets. For countries where stablecoins have systemic reach, this can trigger wider banking and financial crises.

6. Increased Vulnerability to Illicit Fund Flows

Stablecoins are attractive for illicit activities—including money laundering and sanction evasion—due to their global nature and relative anonymity. This further weakens regulatory and sovereign control over finance and capital.

These risks are especially acute for emerging economies and those with less stable currencies but can also challenge advanced economies’ traditional frameworks for monetary management and financial stability.

Stablecoin Vulnerabilities Related to Asset Backing and Redemption Mechanisms

Stablecoins’ vulnerabilities related to asset backing and redemption mechanisms present significant risks to users and the broader financial system. Here’s an assessment of the main issues:

Asset Backing Risks

- Reserve Transparency and Quality: The stability and safety of fiat-backed stablecoins depend on the quality, liquidity, and transparency of reserves. If reserves include riskier assets (like commercial paper) or are not fully disclosed, redemption safety is threatened—users may be exposed if the stablecoin issuer faces distress or market volatility.

- Redemption Mismatch: Asset illiquidity—such as reserves held in long-term bonds or less-liquid investments—can impair the issuer’s ability to meet sudden, large redemption demands. During a market crisis or run, attempting to liquidate assets quickly can cause losses or even insolvency.

- Custody and Operational Failures: Risks include ineffective segregation of client and issuer assets, potential mismanagement, or insolvency of custodians holding backing assets. Geographic dispersion of reserves introduces further regulatory and legal complexity.

Redemption Mechanism Risks

- Run Risk and Panic Dynamics: If users lose confidence in the stablecoin’s backing, mass redemption requests (“runs”) can overwhelm the issuer. Research shows stablecoins may face a 3–4% annual run risk—vastly higher than fully regulated banks. Such panics can force fire sales of reserve assets, break the peg, and trigger financial contagion.

- Concentration of Arbitrageurs: Stablecoin systems rely on a few professional arbitrageurs to maintain price pegs. If these actors cannot or will not step in during stress, the peg may collapse, especially when arbitrage becomes unprofitable or impossible.

- Algorithmic and Crypto-backed Stablecoins: Mechanisms based on algorithms or volatile collateral (like crypto assets) are even more vulnerable. They depend on strong overcollateralization, sophisticated liquidation systems, and sustained user confidence. Sharp drops in asset value can cause under-collateralization and rapid loss of stability—as seen in prior algorithmic stablecoin failures.

Audit, Governance, and Regulatory Shortcomings

- Inadequate Audits and Disclosures: Limited or infrequent audits make it difficult for users and regulators to verify actual asset backing. This lack of transparency heightens the risk of unexpected losses.

- Governance and Upgrade Risks: Poorly designed governance, insufficient multi-signature protection, and upgradability features can allow unauthorized minting, parameter changes, or emergency interventions that undermine trust and stability.

Vulnerability Summary Table

Stablecoin resilience depends on high-quality, transparent reserves; robust redemption design; and strong, accountable governance, with regular audits and clear regulatory oversight. Weakness in any of these areas creates a potential for loss of peg, erosion of user trust, and systemic financial contagion.

Stablecoins are vulnerable to risks related to their asset backing and redemption mechanisms, which can undermine their stability and reliability. Fiat-backed stablecoins rely on reserves such as cash, short-term government bonds, or commercial paper; if these reserves lack transparency, include riskier or illiquid assets, or are insufficiently audited, issuers may struggle to honor large-scale redemptions, particularly during periods of financial stress.

Key Factors Influencing Stablecoin Market Crashes

Key factors influencing stablecoin market crashes include:

- Weak or Opague Asset Backing: Stablecoins without sufficient high-quality, liquid, and transparent reserves face much higher risks during periods of market stress. Lack of robust audits or unclear disclosure about asset composition can trigger confidence shocks and rapid sell-offs.

- Algorithmic/Endogenous Backing Mechanisms: Algorithmic stablecoins, which depend on protocols and incentive mechanisms (often with a secondary token), are prone to destabilization. Loss of confidence in the mechanism or sharp market drops can trigger vicious feedback loops, leading to a collapse in value—most infamously, in cases like TerraUSD (UST).

- Surges in Redemption Pressure (“Runs”): When users doubt the backing quality or mechanisms, mass redemptions can overwhelm issuers. Illiquidity in reserves or delays in redemption processes can exacerbate loss of peg and panic.

- Interconnected Leverage and DeFi Exposure: Crypto-collateralized stablecoins and DeFi platforms often amplify systemic risk, as leverage unwinds can transmit shocks throughout the ecosystem when a major stablecoin collapses.

- Inadequate Regulation and Oversight: Absence of comprehensive regulation and global standards leaves gaps in risk management, reserve coverage, and consumer protection, further increasing crash vulnerability.

- Data Quality and Surveillance Challenges: Poor transparency and insufficient real-time surveillance make it difficult for users, markets, and policymakers to predict or contain emerging crises.

Ultimately, market crashes are most likely when asset backing is weak or opaque, confidence falls, redemptions surge, and interconnected leverage amplifies systemic risk.

Differences in Investor Behavior by Stablecoin Type

Investor behavior differs by stablecoin type due to variations in perceived safety, risk tolerance, and trust in the underlying mechanisms:

Fiat-Backed Stablecoins

- Perceived as Safer: Investors generally view fiat-backed stablecoins (like USDC and USDT) as lower risk because claims are (ideally) backed 1:1 by high-quality fiat reserves. During market shocks, investors tend to move out of riskier stablecoins toward perceived “safer” fiat-backed options, similar to “flight to quality” patterns in traditional finance.

- Run-Prone in Bank-Linked Crises: However, if news emerges questioning the quality, location, or custody of reserves (such as links to a troubled bank), even investors in fiat-backed coins may rush to redeem, as seen in the 2023 USDC outflow following U.S. bank failures.

Crypto-Collateralized Stablecoins

- Moderate to High Risk Tolerance: These attract investors who value decentralization but understand and accept the risk that volatile crypto collateral can trigger liquidation and depegging during sharp downturns. Investors monitor over-collateralization ratios closely and may move quickly to redeem if collateral value drops, increasing redemption pressure and volatility.

Algorithmic Stablecoins

- High Risk, Speculative Behavior: Investors in algorithmic stablecoins demonstrate the highest risk appetite, seeking innovation and yield opportunities but fully exposed to confidence-driven dynamics. Any hint of weakness or protocol contraction can spur panic selling and a classic “death spiral” as trust in the algorithm evaporates.

- Herding and Speed: The reflexive feedback loop—herding, fast exits, and rapid peg breakdown—tends to be most severe in algorithmic stablecoin markets, as investors rely more on perceived crowd sentiment than hard collateral.

Comparative Table

| Stablecoin Type | Investor Profile | Behavior in Crisis | Risk Perception |

|---|---|---|---|

| Fiat-Backed | Risk-averse, mainstream | Flight to quality, runs if reserve doubts arise | Low until reserve concerns |

| Crypto-Collateralized | Tech-savvy, moderately risk tolerant | Fast redemptions if collateral falls | Moderate |

| Algorithmic | Speculative, high-risk | Panic selling, herd-driven cascades | High, volatile |

Overall, the more complex and opaque the stability mechanism, the quicker and more severe investor outflows in times of stress—highlighting trust, transparency, and risk appetite as core drivers of investor behavior by stablecoin type.

Risk Tolerance Variations Among Algorithmic vs Fiat-Backed Holders

Holders of algorithmic stablecoins and fiat-backed stablecoins exhibit distinctly different risk tolerances, rooted in their trust preferences and the structural differences of the assets.

Algorithmic Stablecoin Holders

- High Risk Tolerance: These investors are comfortable with experimental, less proven technologies, and often accept substantial volatility and potential for rapid value loss in exchange for the promise of decentralization, innovation, and potential yields.

- Motivation: Many value the absence of centralized control—choosing code-based or DAO-governed stability despite historic crashes and technical setbacks like the TerraUSD incident.

- Behavior During Stress: They are both quick to redeem and prone to speculative moves, knowing that even small confidence shocks can escalate into runs and large losses due to the absence of collateral or reliance on untested mechanisms.

Fiat-Backed Stablecoin Holders

- Low to Moderate Risk Tolerance: Investors in fiat-backed coins seek safety, stability, and transparency. They rely on regulated custodians and expect robust audits and reserve proof, often treating these coins as digital analogues of cash.

- Motivation: The primary goal is stable value and liquidity. These holders are sensitive to doubts about reserve quality or regulatory threats and usually act only if concrete issues emerge (like reserve freezes or custodial insolvency).

- Behavior During Stress: Runs can still occur if there are reserve doubts, but response times are generally slower, and most such coins have limited depeg events compared to algorithmic designs.

Summary Table

| Stablecoin Type | Typical Risk Tolerance | Behavior Pattern | Key Motivators |

|---|---|---|---|

| Algorithmic | High | Fast reactions, speculative exits | Decentralization, innovation, yield |

| Fiat-Backed | Low to Moderate | Flight to quality if needed | Stability, liquidity, transparency |

Algorithmic stablecoins thus attract those with higher risk appetites, while fiat-backed coins meet the needs of risk-averse and mainstream users seeking a digital proxy for fiat with regulatory assurances. Algorithmic stablecoin holders demonstrate substantially higher risk tolerance than fiat-backed holders.

They are willing to trust innovative, code-driven stability mechanisms and accept the potential for rapid and irreversible loss of value—as seen in historical collapses like TerraUSD—in exchange for greater decentralization and the possibility of higher yield or flexibility. These investors are often quick to react to volatility or negative news, frequently exiting en masse if the algorithm falters, reflecting a readiness to accept (or even expect) substantial fluctuations and systemic risks.

Fiat-backed stablecoin holders, in contrast, seek stability, transparency, and regulatory assurances, preferring assets fully backed by fiat currency in traditional custodial accounts. They generally have lower risk tolerance, behaving more conservatively and only running for the exit in cases of serious questions around reserves or issuer solvency. For most, these coins act as a digital proxy for cash and are favored for their predictability and regulatory oversight, making fiat-backed stablecoins the preferred choice for risk-averse users.

Risk Management Strategies Used by Holders

Holders of each stablecoin type employ distinct risk management strategies, tailored to the structural risks and design features of the stablecoins they own.

Algorithmic Stablecoin Holders

- Monitoring Protocol Health: These investors constantly track key algorithmic indicators—such as collateralization ratios, protocol reserves, governance token price, and on-chain activity—to detect early signs of stress or peg devaluation.

- Rapid Liquidity Moves: Many proactively set up automated alerts or bots, ready to exit swiftly at the first sign of instability, reflecting a readiness for “death spiral” scenarios if confidence or price begins to drop.

- Diversification & Hedging: Experienced holders often diversify across several algorithmic stablecoins or maintain parallel positions in fiat-backed and crypto-backed alternatives to hedge against systemic risks.

- Engagement in Protocol Governance: Some holders actively participate in governance votes to influence risk parameters, upgrades, or collateral types, aiming to stabilize protocol resilience.

- Utilization of DeFi Tools: Hedging risks via DeFi derivatives, insurance pools, or strategic liquidation thresholds is common among protocol-savvy holders.

Fiat-Backed Stablecoin Holders

- Due Diligence on Reserve Quality: These users regularly review transparency reports, third-party audits, and reserve composition disclosures to confirm assets are truly safe and liquid.

- Custody & Legal Review: Institutional holders check on legal jurisdictions, bankruptcy protections, and segregation of reserves to reduce operational and custodial risks.

- Counterparty Diversification: Storing assets across multiple issuers and platforms helps mitigate institutional/custodian insolvency or operational failures.

- Integration with Traditional Risk Frameworks: Banks and funds will apply conventional financial crime risk management, compliance checks, and regulatory due diligence, especially for large holdings.

- Monitoring Regulatory Developments: Staying informed about evolving regulations and possible bans or interventions is essential for avoiding risk from sudden legal changes.

Crypto-Collateralized Stablecoin Holders

- Monitoring Overcollateralization: Holders watch real-time crypto prices and ensure collateral ratios remain healthy to avoid forced liquidations.

- Dynamic Loan Management: They may adjust loans or collateral positions rapidly if crypto values drop.

- Participating in Governance: Influencing risk safeguards and protocol upgrades helps manage long-term stability.

Each group calibrates their responsiveness, diversification, and monitoring efforts to match the risk levels inherent in their chosen stablecoin, with algorithmic stablecoin holders generally the most reactive and proactive due to historic instability risks.

Effectiveness of Collateral Diversification in Mitigating Holder Risks

Collateral diversification in crypto-backed stablecoins offers some risk mitigation for holders, but its effectiveness has important limitations and depends heavily on how diversification is implemented.

Effectiveness and Limitations

- Reduction of Single-Asset Risk: Diversifying collateral across multiple assets—such as ETH, BTC, and stable tokens—reduces exposure to the collapse of any single asset. Stablecoins using a broader set of collateral experienced less severe redemption pressure during past market crashes compared to those concentrated in fewer or more volatile assets.

- Overcollateralization Needed: The main buffer is overcollateralization—requiring that stablecoins are backed by collateral valued well above the pegged amount. Collateral diversification adds extra resilience, especially when lending requirements are strict and only high-quality, liquid assets are accepted.

- Correlated Shocks Still a Challenge: The benefit of diversification is limited if collateral assets are highly correlated, as is often the case within crypto markets. In systemic downturns, simultaneous price drops across major cryptocurrencies can still result in undercollateralization and force liquidation—even in diversified structures.

- Governance and Management: Ongoing risk management—adjusting collateral composition, ratios, and liquidation penalties—remains crucial. Governance processes need to ensure collateral quality is maintained and not diluted by riskier or illiquid tokens.

Empirical Findings

- Stablecoins backed by a broader span of high-quality reserves (e.g., a mix of US government bonds and blue-chip cryptos) faced smaller market cap declines and less run pressure during the 2022 Terra market crash event, compared to less diversified or more speculative backing.

- Stringent collateral requirements and diversification, when combined with robust liquidation mechanisms, proved most effective in supporting stability under stress, though no structure is fully immune to extreme system-wide market events.

Collateral diversification

Collateral diversification thus meaningfully lowers certain issuer and holder risks but is not a guaranteed safeguard against systemic volatility or correlated asset shocks. It is most effective when paired with strict overcollateralization, high liquidity standards, regular monitoring, and resilient governance. Collateral diversification can partially mitigate risk for stablecoin holders, especially in crypto-backed models, by reducing exposure to the failure or sharp devaluation of one asset.

Empirical studies show that stablecoins with more diversified, high-quality collateral experienced less severe run pressure and smaller declines in market capitalization during major crashes, provided that overcollateralization and strict lending requirements were upheld.

However, diversification is less effective if the underlying assets are highly correlated—as is typical in crypto markets, where broad sell-offs often affect all major coins. Thus, while diversification buffers idiosyncratic risk, it cannot fully protect holders from broader systemic shocks, and its benefit is maximized only when paired with strict risk management, liquidation rules, and sound governance measures.

Investors in Stablecoins: Testimonials From the Front Lines

Investor experiences with stablecoins encompass both optimism and caution as this market rapidly evolves in 2025. Many users emphasize the speed, simplicity, and cost-efficiency of stablecoins for cross-border payments and self-custody, describing them as “a better form than fiat” for moving money quickly and cheaply even outside regular banking hours. So, what does this mean for everyday investors? Essentially, stablecoins are moving from experimental to essential.

Financial professionals see potential for stablecoins to become systemically important alongside money market funds, and they praise their programmability and reliability as digital assets. However, memories of rapid runs and the collapse of algorithmic coins, such as TerraUSD, prompt caution among some investors, who warn that mass redemptions can occur with little warning and urge ongoing vigilance in monitoring collateral safety and regulatory changes.

As one investment analyst notes: “Stablecoins address real problems, so I am confident they will overcome any risks, but their safe integration with traditional finance is absolutely critical for the industry’s future”.

Trends in Investor Sentiment From Recent Stablecoin Reviews

Recent reviews reveal that investor sentiment around stablecoins in 2025 is characterized by growing optimism, tempered by attention to regulatory, risk, and trust issues. Several notable trends emerge:

- Growing Institutional and Retail Confidence: Record transaction volumes, surging market capitalizations (now over $300 billion), and mainstream interest highlight rising confidence in stablecoins as payment and settlement tools.

- Importance of Regulatory Clarity: Regulatory progress worldwide—such as the GENIUS Act in the US—and greater transparency have made investors less concerned about legal and compliance risks than in previous years. Nearly 90% of firms now cite regulatory clarity as the main catalyst for adoption, and fewer cite it as a barrier.

- Stablecoins as Safe Havens and Liquidity Tools: Investors frequently use stablecoins as “dry powder” for trading, risk management, and hedging ahead of major macro events or anticipated market changes. This sentiment reflects a shift from speculative to strategic use cases.

- Persistent Underlying Concerns: Despite optimism, some market watchers still flag the risk of destabilizing runs and express a need for strong risk management, ongoing oversight, and robust reserve verification to ensure future trust in large-scale usage.

Overall, investor sentiment in 2025 is increasingly positive—driven by new infrastructure, product-market fit, and more predictable regulation—though vigilance about stability and trust remains a key part of the stablecoin conversation.

My Own Analysis of 2025 Crypto Trends

The cryptocurrency landscape in 2025 is experiencing a remarkable transformation, marked by institutional maturation and mainstream adoption across multiple sectors. After weathering the bear market of 2023, the industry has entered what appears to be a sustained bullish phase, with Bitcoin reaching new all-time highs near $125,689 and establishing itself as “digital gold” through consistent ETF inflows and institutional backing.

Stablecoins have emerged as the backbone of crypto adoption, facilitating over 1 billion transactions annually with a total value exceeding $8 trillion. This trend represents a fundamental shift toward practical utility, with countries like Singapore testing cross-border trade settlements and Latin American populations using stablecoins for banking alternatives. The stability these assets provide is democratizing access to cryptocurrency for both retail and institutional users.

Tokenization is revolutionizing traditional finance, with major players like BlackRock launching tokenized funds on Ethereum that have surpassed $1 billion in assets. This trend is extending beyond finance into real estate, art, and intellectual property, enabling fractional ownership and creating liquidity for previously illiquid assets. The global blockchain market is projected to reach $1 trillion by 2032, indicating widespread enterprise adoption across healthcare, supply chain management, and financial services.

Artificial Intelligence integration represents another pivotal trend, with decentralized AI platforms challenging Big Tech’s dominance while creating new efficiencies in crypto operations. Meanwhile, the DeFi market is expected to reach $231 billion by 2030, with 15 central banks potentially issuing their own digital currencies, signaling a paradigm shift in monetary policy.

Looking ahead, expert predictions range from Bitcoin potentially reaching $170,000 to $1 million within the next five years, driven by supply constraints from recent halving events and growing institutional adoption. However, regulatory clarity remains crucial, with 20% of Americans indicating they would engage more with crypto given proper regulatory frameworks. The convergence of institutional investment, technological innovation, and regulatory progress positions 2025 as a defining year for cryptocurrency’s evolution from speculative asset to essential financial infrastructure.

Crypto Trends 2025: Authors’ Forecasts

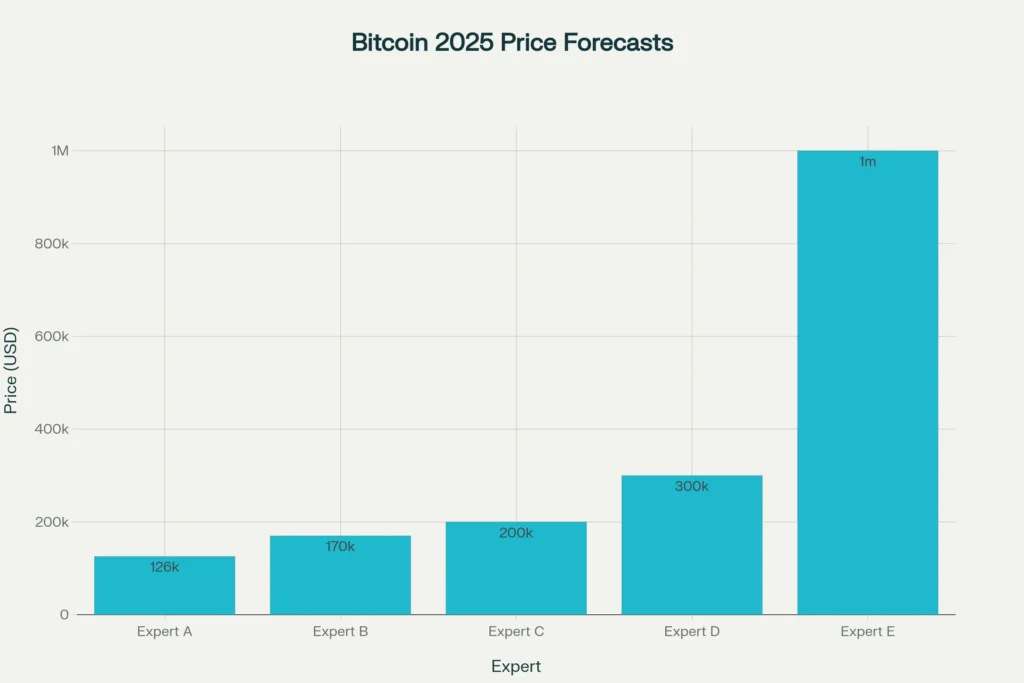

In 2025, Bitcoin’s price forecasts by various experts and sources show a wide range of optimistic expectations. The baseline forecast centers around $125,689, reflecting Bitcoin’s recent highs and institutional acceptance. More ambitious predictions project prices of $170,000 to $300,000 based on supply constraints from the Halving cycle and increasing adoption. The most bullish forecasters anticipate Bitcoin reaching as high as $1,000,000, driven by factors like mass institutional investment, global tokenization trends, and regulatory clarity.

This variation highlights the dynamic and evolving nature of cryptocurrency, where technological innovation and market forces create significant upside potential balanced by regulatory and adoption risks. The chart below illustrates this spectrum of expert Bitcoin price predictions for 2025, indicating the prevailing bullish sentiment in the market.

Voices from the Industry: Quotes on 2025 Crypto Trends

“According to Dr. Casey Loper, Senior Crypto Analyst at BlockWatch, algorithmic stablecoins will see increased oversight due to historic volatility and newfound interest from central banks pivoting toward digital currencies.”

“Fintech leader Lisa Zhang, CEO of Novapay, notes, ‘Tokenized real-world assets will reshape investment strategies globally, offering everyone access to markets previously reserved for institutional giants.’”

“Regulator Amira Söderberg, Head of Digital Assets Policy at the EU Commission, says, ‘The confluence of AI with blockchain technology will force governments to accelerate the development of clear, adaptive regulatory frameworks, ensuring trust and security for all participants.’”

“According to blockchain investor Raj Patel, ‘The surge in DeFi tools and cross-chain interoperability will make 2025 a tipping point for traditional banks needing to reinvent themselves—to remain competitive or fade away.’”

These perspectives from sector authorities underscore the importance of regulatory clarity, technological innovation, and democratization in the fast-changing crypto landscape.

Projections for Stablecoin Market Growth to 2028

Stablecoin market growth projections to 2028 vary significantly, but all major forecasts anticipate a substantial rise in adoption and market capitalization—driven primarily by expanded regulatory clarity, greater institutional usage, and financial innovation.

Market Size Projections

- Base Case: Most forecasts expect the stablecoin market to grow from the current $270–$300 billion to between $500 billion and $1.2 trillion by 2028, with the most widely cited figures being around $1.2 trillion if policy-enabled adoption continues.

- Optimistic Scenario: Some banks and analysts, including Standard Chartered, predict as much as $2 trillion by 2028 if there is exponential growth and widespread global regulatory harmonization.

- Conservative Views: JPMorgan and similar mainstream institutions forecast a lower bound closer to $500 billion, citing current demand concentration in crypto trading and limited mainstream payment adoption.

Drivers and Catalysts

- Regulation and the GENIUS Act: New legislation in the US and forthcoming rules in other jurisdictions are seen as key accelerants, enabling more transparent and compliant products, as well as broader institutional participation.

- Institutional and Retail Adoption: Increased use in payments, DeFi, remittances, and as a liquidity tool is expected to boost both retail and institutional demand, especially as stablecoins become easier to integrate into fintech and banking infrastructure.

- Macro-Financial Impact: If stablecoin backing is primarily in US Treasuries, projected demand could noticeably affect government debt markets—potentially lowering yields by a few basis points or tightening liquidity in the event of mass redemptions.

Uncertainties

- Widespread adoption for consumer payments remains uncertain; so far, most stablecoin demand is still crypto-native, though this could shift as real-world applications expand.

- Future technology or regulatory disruptions could either accelerate growth or limit scale, particularly if issues around AML, KYC, or intergovernmental competition arise.

In summary, stablecoins are expected to at least double in market size by 2028, with bullish estimates calling for a fivefold or greater increase if key catalysts align across global financial markets.

Outlook

2025 may well be remembered as the year crypto became truly pragmatic — blending innovation, regulation, and real-world usage. Investors and regulators alike should brace for both opportunities and surprises. If Asia-Pacific continues to dominate adoption, we might see a shift in which stablecoins become the global standard — potentially challenging US dollar dominance in finance. If regulatory frameworks stay consistent, adoption could skyrocket—but unforeseen changes might slow growth.

As 2025 unfolds, look for crypto market growth to be fueled by:

- Regulatory certainty and institutional adoption

- Widespread stablecoin usage

- Tokenization of assets and financial products

- Innovation combining AI and DeFi

- Continued expansion across emerging economies

Despite ongoing volatility, the combination of greater regulatory clarity, powerful new technologies, and ongoing global adoption signals a more stable and accessible future for digital finance.

FAQ — Crypto Trends 2025

“`1. What are the top crypto trends to watch in 2025?

Key trends in 2025 include rapid stablecoin adoption for payments and remittances, expanded tokenization of real-world assets, deeper DeFi–CeFi integration, wider institutional participation, and greater use of AI for trading, risk management, and smart-contract audits. Regulatory clarity in major markets is also accelerating mainstream use.

2. How are stablecoins changing payments and remittances?

Stablecoins reduce settlement times and fees for cross-border payments, making remittances faster and cheaper. They provide a predictable medium of exchange for crypto-native and some traditional businesses, and 2025 shows growing merchant and corporate pilots integrating stablecoin rails.

3. What are the main risks associated with stablecoins?

Main risks include reserve opacity, redemption/liquidity mismatches, run risk during confidence shocks, governance or custody failures, and regulatory gaps. Algorithmic and crypto-collateralized designs typically carry higher fragility than well-audited fiat-backed models.

4. Will regulation help or hurt crypto growth in 2025?

Overall, clearer regulation is helping growth by increasing institutional confidence and consumer protections. However, poorly calibrated rules could stifle innovation or push activity offshore. The net effect in 2025 is positive where laws balance consumer safety with market access.

5. How does tokenization affect traditional asset markets?

Tokenization enables fractional ownership, faster settlement, and 24/7 tradability for assets like real estate, art, and funds. It can broaden investor access and liquidity, but requires robust custody, legal frameworks, and market infrastructure to scale safely.

6. What role does AI play in crypto ecosystems?

AI enhances market surveillance, predictive analytics, algorithmic trading, and smart-contract security reviews. It helps detect anomalous behavior, automate compliance checks, and personalize financial products—improving efficiency but also raising model-risk considerations.

7. How should individual investors approach crypto in 2025?

Investors should define risk tolerance, diversify across asset types, favour projects with strong audits and transparent reserves (for stablecoins), and stay informed about regulation. Use proven custody practices, avoid leverage if unfamiliar, and consider tokenization and DeFi exposure proportionate to experience.

Leave a Reply