Learning forex starts with understanding the impact of prices on the market. One great tool in a forex trader’s toolkit is the forex candlestick. This is a visual illustration that offers them great insights into price swings. As a beginner or a seasoned trader, taking the time to understand forex candlestick patterns helps you learn the market sentiment, predict trends, and make the right trading choices. This article explores the importance of forex candlesticks and how they can help you improve your trading skills.

Measurement of Market Attitude

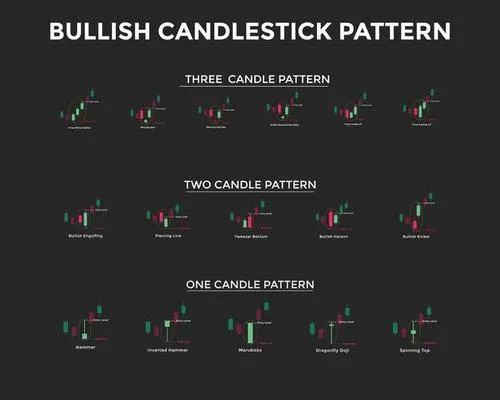

Beyond just raw data, forex candlesticks provide insights into the psychology of the market. For instance, a long-bodied bullish candle following a series of bearish ones would show a shift in attitude. Understanding the nuances of candlesticks will help you understand the views of other market players. This is where candlestick forex patterns flourish. By recognizing patterns like Hammers, Evening Stars, or Engulfing patterns, you can quickly develop an emotional sense of the market.

Value Representation

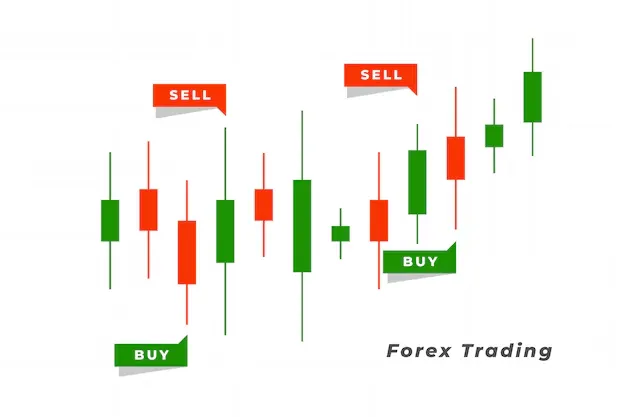

Forex candlesticks help traders visualize the change in price over time. Every candlestick shows the dynamic between buyers and sellers. It is an opening and closing indicator, while the wick of the candles shows the highs and lows. The battle between bulls and bears will help you understand the patterns in forex, although this is difficult but not impossible while using bar charts.

Figure Reversal and Continuation Patterns

Forex candlestick patterns get their power from their predictive ability. Traders have found regular patterns in forex candlesticks that produce trend reversal or continuation. Examples of reversal patterns are the Hammer, Inverted Hammer, Shooting Star, and Morning Star that help in identifying potential trend changes. Recognizing and interpreting candlestick patterns allows you to predict the trends in the market and modify your strategy.

Verifying Resistance and Support

Forex candles enable you to identify significant technical levels in the forex exchange. Your instincts that a market rebound is near can be boosted by a bullish engulfing pattern at a known zone. Using forex candlesticks together with trendlines or horizontal support/resistance will help you make much more precise trading choices. This cooperation enhances your confidence when making entries or exits and helps you to avoid wrong signals. When they coincide with significant price levels, high-chance trading utilizing candlestick patterns for forex emerges.

Extends Trading Duration

Forex candlesticks enable quick judgments based on live price action instead of being bogged down in sophisticated indicators or lagging measures. This is particularly helpful for swing traders analyzing daily or weekly charts, or for intraday traders requiring a rapid reaction. Knowing the basic and complex candlestick formation forex patterns will help you to observe how much quicker and precisely you can react to market swings.

Conclusion

More than just forms on a diagram, forex candlesticks serve as a visual indicator telling the story of market mood, power conflicts, and tipping points. Every trader should understand forex candlestick patterns because they are a versatile tool that helps identify reversal signals and confirm support and resistance levels. Studying how forex candle patterns relate to more conventional technical analysis will enable you to start developing strategies founded on price action and chance.

Leave a Reply