Introduction

It is no secret that AI-powered stock analysis has completely transformed the way we approach investments and access to cutting-edge tools are something that a lot of us look at in order to be ahead in the financial world. Not only are these new platforms revolutionizing the way we look at stocks — but they’re changing our day-to-day, and giving us access to opportunities we thought could never be possible.

This in-depth analysis will examine the 9 best AI-powered stock analysis solutions to give a clear understanding of what each has to offer, where it provides value, as well as its limitations. So whether you’re an investment rookie, or a seasoned veteran interested in brushing up on your analysis, this research handbook will give you the tools and resources necessary to find the answers that work for your financial goals and situation.

Website List

1. BestStock AI

What is BestStock AI

BestStock AI BestStock is an AI-powered stock data analysis tool that makes it easier to analyze your financial information for investment teams – It processes all financial data automatically and provides near real-time actionable insights with auto-generated reports, while providing access to professional market data and powerful analytics that help you make better decisions with less effort—and it also has an options profit calculator that visualizes potential P/L, breakevens, risk-reward which helps you quickly solidify entries, exits & strategy selection.

Features

- Computationally intelligent financial analysis that saves time automating data crunching and gives actionable advice – no guesswork needed!

- Full US stock financials, earnings transcript & daily AI-powered insights at your fingertips with this 3-in-1 advanced market intelligence app (No Ads)

- Sophisticated statistical and business analyzes for deep financial performance and trends reviewing

- Easy use interface that makes flow of research easy for investment professionals or beginners

- Sensorial blending of curated research for informed decision-making and improved investment strategies

Pros and Cons

Pros:

- Intelligently analyze your data with powerful AI technology, extract valuable insights without manual effort!

- Complete market data coverage with breaking news, analysis and earnings transcripts of US stocks

- Smooth work flow to make timely investment decision for our fund managers

- Easy-to-use interface to make reporting and charting easy

Cons:

- It may have learning curve for those who are not acquainted with AI tools

- Lack of customisation for unique financial reporting requirements

- Sporadic delays in performance during peak traffic or heavy use periods

2. Forecaster

What is Forecaster

Forecaster is an awesome online tool to assist making decisions based on accurate predictions and trends around lots of different areas such as finance, weather and markets etc. At its core, the goal is to use sophisticated algorithms and data analysis to provide accurate forecasts that will allow people and businesses alike to plan ahead, know what’s coming. With simple interface and custom reports, Forecaster makes it an indispensable tool for people who seek to improve their forecasting.

Features

- The intuitive SmartApp UI which improves user experience and onboarding time

- Strong security to safeguard sensitive data and maintain compliance

- Tools for real-time collaboration, better team work and project management

- Reporting (comprehensive and analytics to see performance and drive strategy

- Customizable workflows that match your business process.

Pros and Cons

Pros:

- Task-based workflows (we can optimize your tasks using forecasting-style, time-series ARIMA/Prophet style, or ML ensembles to generate forward price/volattility scenarios)

- Scenario and sensi analysis to challenge assumptions, confidence intervals and stress cases on macro or company specific drivers

- Easy comparison forecast bands with historical price, providing error metrics (MAE/MAPE) in order to understand model accuracy over time

- Automation capabilities such as scheduled re-forecasts, alerting for deviation from forecasted paths and API/export for integration

Cons:

- Outputs are sensitive to input quality and parameter selections; risk of overfitting if not cross-validated.

- Less depth in primary research and qualitative versus full-service equity research platforms

- Forecast ranges may lead to overconfidence; probabilistic bands may be misinterpreted as specific levels.

- Real-time and alternative data Additional coverage limitations may apply to lower tiers limiting the responsiveness and breadth of your forecast(predictions).

3. Stockinsights

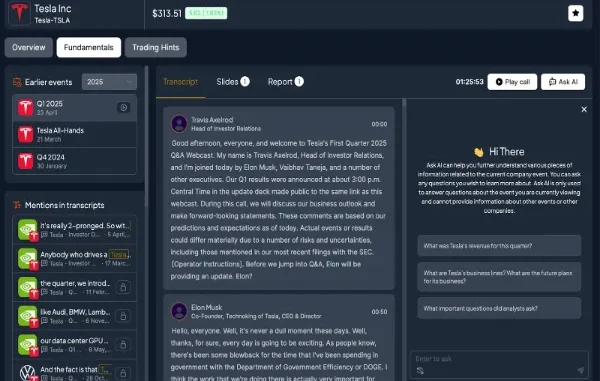

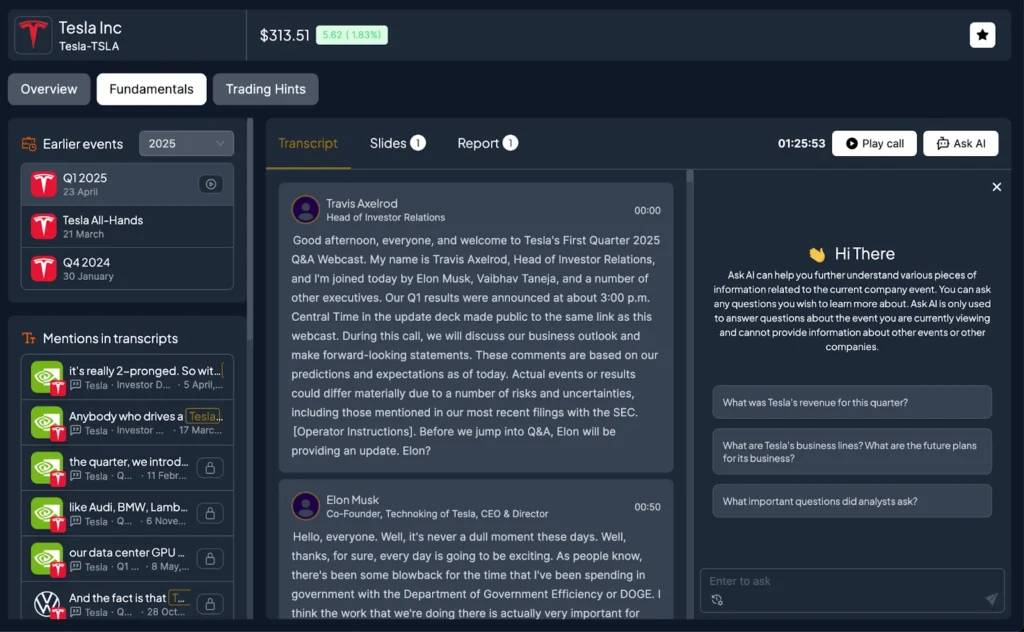

What is Stockinsights

Stockinsights is a cutting-edge financial research platform powered by adaptive AI that simplifies the process of analyzing public company filings and earning calls. Target audience are value investors and it will save you a lot of screen time gathering data, just to turn around grind quality data, synthesise investing thesis, rather than researching the actual invesment case. By covering the US and Indian markets, Stockinsights makes it easy for investors to keep an eye on their portfolio companies and come up with new investment ideas more efficiently than ever before.

Features

- AI tools that allow investors to more easily analyze public company filings and earning transcripts

- Integrated insights from multiple data sets to make informed investment decisions

- Productivity boosters built specifically for value investors

- Easy tracking of portfolio companies to keep you updated on your investment

- Easy-to-use interface suitable for both investors new to the markets

Pros and Cons

Pros:

- AI features that improve research capabilities and productivity

- Complete analysis of the trends and opportunities offered by all of these markets for investing purposes

- Time-saving due diligence process saving time on often laborious ground truthing work

- Tailored to value investors, and customized for their specific investment needs

Cons:

- Limited to US and India markets at the moment

- May take some getting used to for anyone who has never worked with an AI tool

- More dependence on technology might not be conducive to conventional forms of research

4. AlphaInsider

What is AlphaInsider

AlphaInsider is a ground-breaking open market that brings together traders and investors with unique trading strategies. Although, its primary goal is to empower users by making available trading patterns and other proven techniques used by experts so that they can take better trading decisions and enhance their performance as a trader. Whilst promoting cooperation and the sharing of information, AlphaInsider makes a major contribution to the trading community by creating a more inclusive environment where knowledge is power.

Features

- Leading edge machine learning tech which personalizes user experience to behavior

- Easy to navigate dashboard. Perfect for beginners and experienced users alike

- Collaboration features to improve communication and project management

- Performance metrics and insights for data-driven decision-making

- Inter-device synchronizing allowing access wherever and whenever

Pros and Cons

Pros:

- Concentrate on insider transactions and institutional holdings, turning Form 4/13D/13F filings into actionable alerts and dashboards

- Smart filters (role, size, cluster buys, timing vs. blackout windows) to bubble up high conviction insider activity

- price/volume and event-based timeline integrations to frame insider moves with market reactions

- And, Export/API and Watch lists allow workflow integration on quant screens and discretionary research

Cons:

- Insider buys/sells signals are often noisy; reasons (diversification, tax, preset plans) change don’t mean a stock’s fundamentals do.

- Coverage lag also reflects filing processing; intraday timeliness may be delayed relative to price-based signals

- Low depth when it comes to valuation/fundamental modeling; best utilized as an alpha signal PORTAL Alpha delivers, not a standalone platform

- Often there’s paywalled advanced filters, historical backfill and data exports which can increase the total cost for power users.

5. Danelfin

What is Danelfin

Danelfin is an all-in-one financial management system created to assist in organizing the personal and business affairs of people. Its focus is on tools for budgeting and tracking expenses and investments so that you can make informed decisions, set financial goals, and achieve them. Danelfin has a user-friendly interface and science-based functionality to accomplish processing of complex financial operations and increase overall level of financial competence.

Features

- Easy to use menus with fast and simple navigation keeping you HUD free at all times

- At-the-moment analytics and reporting to make evidence-based decisions

- Scalable solutions: A la carte in nature, designed to accommodate businesses of every size.

- Full training materials and documentation for successful onboarding

- Powerful collaboration features that encourage team communication and productivity

Pros and Cons

Pros:

- A.I-generated stock scores that factor in technical, fundamental and sentiment signals into a single probability-style rating for outperformance

- Persuasive, easy-to-understand visuals (heatmaps, grades, and risk levels) that allow non-quant users to act upon model outputs with little delay

- Measure reliability with strategy backtests, model transparency (importance, factor contribution) panels.

- Tools and alerts to monitor score changes, rebalance prompts and risk flags for all holdings

Cons:

- Black-box components persist; little scope for complete audit of model structure or generation of signals in isolation

- Performance may be regime dependent; when signals that in series in successful phases do not work vs choppy and/or macro driven.

- For smaller or non-U. S. stocks will lag behind large-cap U.S. names

- Advanced analytics, historical exports or integration features you usually pay for with higher-priced tiers

6. TrendSpider

What is TrendSpider

TrendSpider is a revolutionary trading tool that automates the process of identifying market trends to help traders make better informed trade decisions. It is primarily designed as a working tool to improve technical analysis with features such as intelligent charting tools, automatic trend lines and backtesting options enabling traders to perfect their trading strategies. Focusing on efficiency and precision, TrendSpider works to make the trading process smoother for all traders, regardless of experience.

Features

- User friendly experience with an intuitive interface for easy navigation and great browsing.

- Real-time data analysis for smart decisions and strategic insights

- Scalable solutions for as business needs change and your business scales upwebElementProperties

- “Best Practices” training to make your team self-sufficient and productive

- Powerful reporting tools for detailed performance analysis and optimization

Pros and Cons

Pros:

- Powerful advanced charting including auto Trend Lines, Pivot Points and Analysis Over 100 of the most popular indicators.

- Powerful scans and alerts: no-code strategy backtester, dynamic scanners, event condition alerting (candles, indicators, breakouts) for all timeframes

- Backtesting & strategy development: visual rules engine with walk-forward testing, sensitivity analysis and performance stats

- Data & workflow depth: broad indicator library, Raindrop charts, seasonality/heatmaps, multi-asset coverage; broker integrations for chart-trading

Cons:

- Steep learning curve for new users due to no. of tools,options to configure

- Mostly based on technical analysis as fare, limited fundamental data and valuation modeling available compared to other research platforms

- Backtests can be overfitted if not independently validated with out-of-sample and realistic execution assumptions (slippage, spreads)

- More advanced features (intraday data depth, sophisticated scans, market breadth datasets) may be expensive for retail traders

7. StocksToTrade

What is StocksToTrade

StocksToTrade StocksToTrade is an all-in-one trading platform built to assist new and experienced traders with stock trades. It provides a full range of tools to allow ambitious traders and investors around the world to trade smarter, and maximise their profits from Forex (FX), Index, Stock and Commodity trading. Offering up indispensable trading tools, piercing market scrutiny and education for those ready to get to grips with day trading & investing, StocksToTrade has plenty of value to offer.

Features

- Trading guides and learning material for traders of all experience levels

- Premium trading tools, such as stock scanners and chart pattern recognition for more informed trades

- Streaming, customizable quotes and watch lists for tracking your favorite stocks in real time

- Trading layouts with trading setups tailored to you and that are customisable to optimise your trading contrariadoresignaux.review experience and workflow

- A community of traders, collaborating and sharing trading strategies for success

Pros and Cons

Pros:

- Educative resources available, encompassing guides and articles for both rookies as well as professional traders

- Advanced trading tools and resources, i.e. Level 2 quotes & stock scanners

- Variety of trading strategies and methods, with respect to their varying time frames suited for each trader.

- Real-time data with market and performance updates for better decision-making

Cons:

- It may be overwhelming for beginners because of the huge amount content

- More advanced trading tools might be more difficult to use if you’re new to forex trading and still learning the ropes.

- Limited support for certain broker integrations or trading platforms might limit options users have.

8. Finbox

What is Finbox

Finbox is a suite of financial tools that helps investors conduct analysis, value and monitor stocks. Its primary goal is to facilitate investment research by users and provide access to comprehensive data on a company so they can make more informed decisions. Performance With features such as advanced financial modeling and powerful data visualization, Finbox offers substantial value through improvement of investment analysis for beginners and professionals alike.

Features

- Cutting edge machine learning models that get better over time

- Dashboard is easy to use for anyone from novice computer users to artists with years of experience!

- Communication tools that promote team work and project management integrations with Pivotal Tracker and Verizon Video Media Services.

- Detailed analytics and metrics to make important decisions with confidence

- Synchronize across devices for a consistent experience on either computter or smartphone

Pros and Cons

Pros:

- Strong security measures to keep data secure and compliant

- Frequent feature additions and updates that add functionality and improve your user experience

- Good integration with popular third-party applications

Cons:

- More expensive initial setup than some competitors

- Limited support for outdated systems and obsolete technologies

- Some of the advanced features need more training for optimal usage.

9. Stockgeist

What is Stockgeist

Stockgeist is a real-time market sentiment monitoring tool powered by AI and deep learning analysing the social media feeds of 2,200 listed companies. It is best suited for creating actionable advice for traders and investors about market trends or sentiment changes, so they can act quickly. Stockgeist translates massive amounts of text data into easy-to-use analytics): Improving portfolio performance and predicting changes in stock dynamics.

Features

- Real-time public sentiment of 2,200 publicly traded companies for making informed trading decisions

- Intelligent analysis that organizes complex data from social media into practical intelligence, using AI

- Interactive finance chatbot for real-time stock and cryptocurrency advice

- Improved predictive analytics to optimize hedge fund performance and market positioning

- Friendly user interface for quick data access and analyzation without any need of programming skills.

Pros and Cons

Pros:

- Premium AI-guided analysis to track market sentiment for 2200+ companies in real-time

- Highly user-friendly interface makes it easy for traders to decipher massive amounts of data from social media

- A chatbot that gives instant financial advice on stocks and cryptocurrencies

- Useful tool for hedge funds to exploit sentiment data to improve their portfolio performance

Cons:

- Over reliance on social media data can result in noises and inaccuracies in sentiment analysis.

- Not a lot of details on customizations available for various trading strategies

- Potential difficulties in understanding the platform for users less AI-savvy parties

Key Takeaways

- Do your research before opting for an AI-based stock analysis tool and check the relative sophistication, accuracy etc. offered by different tools.

- When you’re weighing your options, think about what’s going to be right for you in particular—what are you investing for and how comfortable are you with risk—and then if budget is a problem, consider that.

- Begin with free trials, if available, to try out the AI tool and see if it fits your trading style before putting money on the line.

- Learn from other users: We are publishing customer reviews and testimonials to highlight the benefits of our AI solutions as experienced by actual users.

- Keep up to date as the technology and market changes with new options for AI stock analysis so quickly.

- Customer Support, and community resources – They not only add to your experience while working with the tool, but a good support can also increase your effectiveness.

- Pick: Think about scalability and future growth when you are making your choice – this allows the solution to expand with your investment requirements as they develop over time.

Conclusion

And there you have it, out top 9 AI stock analysis tools explained – As we’ve seen today, the market has job for almost everyone in terms of investing styles. Due to the nature of the game, you must be able to understand your own trading style and know what platform suits that style best for the most precise advanced analytics, user-friendly interface, and ease on cost.

So whether you are a retail investor seeking to bolster your portfolio, or a financial advisor tasked with introducing clients to evidence driven research, the solutions highlighted in this article stand out as the best of breed available. Both platforms have strengths, with advanced predictive modeling and real-time market data served up alongside excellent customer support by both.

We hope you find this guide useful as you begin your search, though keep in mind that we recommend that you determine which of these tools best suits your needs by using them yourself. The future of AI-driven stock analysis is bright, and selecting the right solution today can set you up for success in the years to come. Jump in and navigate through the choices to charge up your investing with full power today!

Leave a Reply